Loan Affiliate Programs can be incredibly useful for individuals and businesses, especially in the financial and marketing sectors. Before proceeding to the Top Loan Affiliate Programs, first, let’s check whether this industry is worthy or not in the affiliate marketing world.

What Are Loan Affiliate Programs?

Loan affiliate programs are partnerships where affiliates promote loan products from lenders and earn a commission for each successful referral or approved loan application. These programs connect borrowers with lenders while rewarding affiliates for driving leads or conversions.

Understanding Affiliate Marketing in the Loan Industry

Affiliate marketing in the loan industry involves promoting loan products, such as personal, business, or mortgage loans, through an Affiliate Network or partnership. Affiliates act as intermediaries, connecting potential borrowers with lenders by using blogs, websites, or paid advertising (if allowed by the advertiser). When a referral results in a successful loan application or lead, affiliates earn a commission.

This model benefits all parties: lenders gain qualified leads, borrowers find suitable financial solutions, and affiliates generate income. With high-demand loan products and attractive commissions, the loan industry presents lucrative opportunities for affiliate marketers.

How They Work and Benefits of Joining

Loan affiliate programs allow affiliates to promote loan products offered by lenders through unique affiliate links or marketing tools. Affiliates earn commissions when their referrals result in successful loan applications or qualified leads. These programs work by leveraging websites, blogs, social media, etc. to connect potential borrowers with lenders.

The benefits of Joining Loan Affiliate Programs include high earning potential due to the large transaction values, competitive commission rates, passive income opportunities, and flexibility to promote various loan types like personal, business, or mortgage loans. Additionally, affiliate marketing networks often provide tracking tools and marketing support, making it easier to optimize performance and maximize earnings.

Why Promote Loan Products as an Affiliate?

High Commission Potential and Targeted Audience

Loan affiliate programs offer high commission potential due to the substantial value of loan products. Affiliates can maximize earnings by targeting a specific audience—individuals or businesses seeking financial solutions. By focusing on a well-defined audience, affiliates can drive higher-quality leads, improve conversion rates, and generate significant income while meeting borrower needs effectively.

Diverse Loan Options and Passive Income Opportunities

Loan affiliate programs offer a variety of loan options, including personal, business, auto, home, educational, express, payday, and mortgage loans, allowing affiliates to cater to different audience needs. By promoting these options through blogs, websites, social media, or any web page, affiliates can generate passive income, earning commissions on successful referrals. With the evergreen demand for loans, these programs provide long-term earning potential with minimal ongoing effort.

Key Features to Look for in a Loan Affiliate Program

Competitive Commission, Reliable Tracking, and Support

Loan affiliate programs offer competitive commissions, rewarding affiliates for high-value leads or successful loan applications. They provide reliable tracking systems to monitor clicks, leads, and conversions accurately, ensuring affiliates get credit for their efforts. Additionally, programs include marketing support, such as banners, landing pages, and performance insights, helping affiliates optimize their campaigns and maximize earnings efficiently.

Reputation and User-Friendly Application Process

Reputable loan affiliate programs ensure trust and reliability by partnering with established lenders, giving affiliates confidence in promoting quality services. They also feature a user-friendly application process, making it easier for potential borrowers to apply for loans. Simplified workflows enhance the borrower experience, leading to higher conversions and improved earnings for affiliates, while maintaining credibility and satisfaction for all parties involved.

Now, let’s move on to the best loan affiliate programs!

18 Best Loan Affiliate Programs!

Firstly, check why the below-mentioned Loan Affiliate Programs are the best.

- Trustworthy and Reliable

- Competitive Commission Rates and Timely Payouts

- Almost all loan types are available such as personal loans, business loans, mortgages, home loans, auto loans, education loans, etc.

- Top Affiliate Marketing Networks provide marketing support like banners, landing pages, and robust tracking tools to simplify promotion and performance monitoring (monitor clicks, referrals, and commissions effectively). Additionally, they have transparent terms and conditions and good customer service.

- High conversion rates so you can focus on quality leads

Let’s get started!

Loan Hub Affiliate Program India: ₹900 Commission

The Loan Hub Affiliate Program has got high commission rates. Moreover, it has a long cookie duration of 30 days. However, deeplinking is not allowed, and also social media promotions are barred. But the good part is that you can attract users via cashback/incentive offers.

This loan affiliate program gets you ₹900 commission on loan disbursal (CPL). Make sure to target users in the age range of 18-55 years with min ₹25k/month salary, and a CIBIL of 650+. Also, the minimum payday loan amount should be ₹8k and max of ₹1 Lakh.

Nexo Crypto Loan Affiliate Program

The Nexo Affiliate Program for Crypto Loans is highly regarded for its attractive commissions, user-friendly features, and the growing popularity of crypto products. Affiliates can earn 11.40% of interest on loans through referrals, plus 0.57% on loan/borrow amounts and 0.11% on digital asset exchanges. This recurring income model is more profitable than one-time commissions. With a global reach in over 200 jurisdictions, Nexo enables affiliates to target a wide audience. The program also offers same-day payouts for top publishers, ensuring quick compensation.

Pros

- Recurring commissions provide a steady income stream as long as the referred users remain active borrowers.

- Payments in crypto allow affiliates to accumulate assets that may appreciate.

- High Cookie Period: 30 Days

- 100% Validation Rate

Cons

- Crypto lending demand is tied to market conditions; during bear markets, loan demand might decrease, impacting affiliate earnings.

- Affiliates unfamiliar with crypto might need to invest time in understanding the industry and the Nexo platform.

LoanOnline Affiliate Program Philippines

The LoanOnline Affiliate Program has a 100% validation rate so if a loan is sanctioned then surely you will get the commission, which is ₹458.41 per Lead. Moreover, it has a 30-day cookie so the conversion rate is high. However, make a note that this loan affiliate campaign validates LoanOnline new user applications only.

Pros

- Opportunities across personal loans, payday loans, business loans, and more.

- 30 Days Long Cookie

- Deals, Coupons, Cashback/Incentives, and Social Media promotions are allowed

- Common methods include cost-per-lead (CPL), cost-per-action (CPA), or revenue share.

Cons

- Associating with subpar lenders could harm your credibility.

- Loans like payday lending can be predatory, which might conflict with personal values.

StateFarm LightStream Loan Affiliate Program US

The StateFarm LightStream Loan Affiliate Program is highly regarded in affiliate marketing due to its attractive benefits and competitive offerings (₹0.12 dynamic CPC commission), but it also comes with some drawbacks.

Pros

- LightStream is a division of Truist Bank, ensuring a reliable and trustworthy partnership. This association boosts credibility when promoting loans.

- Affiliates can earn significant commissions by promoting loans, especially given LightStream’s competitive loan products with low interest rates and no fees.

Cons

- LightStream targets high-credit borrowers, which can limit the affiliate audience and reduce conversion rates for some platforms.

- The program doesn’t offer prequalification for loans, requiring a hard credit check that may deter some users from proceeding.

SalaryOnTime Affiliate Program India

This SalaryOnTime Affiliate Program provides ₹900 commission per lead for successful loan disbursals. Tracking takes a week while validation and commission payout is done by 2 months.

This Loan affiliate program is targeted toward salaried individuals. You will get creative & appealing monetizable content ready so you can focus on your content. This campaign allows cashback/incentive offers and has a 30 day cookie period for better conversion rates.

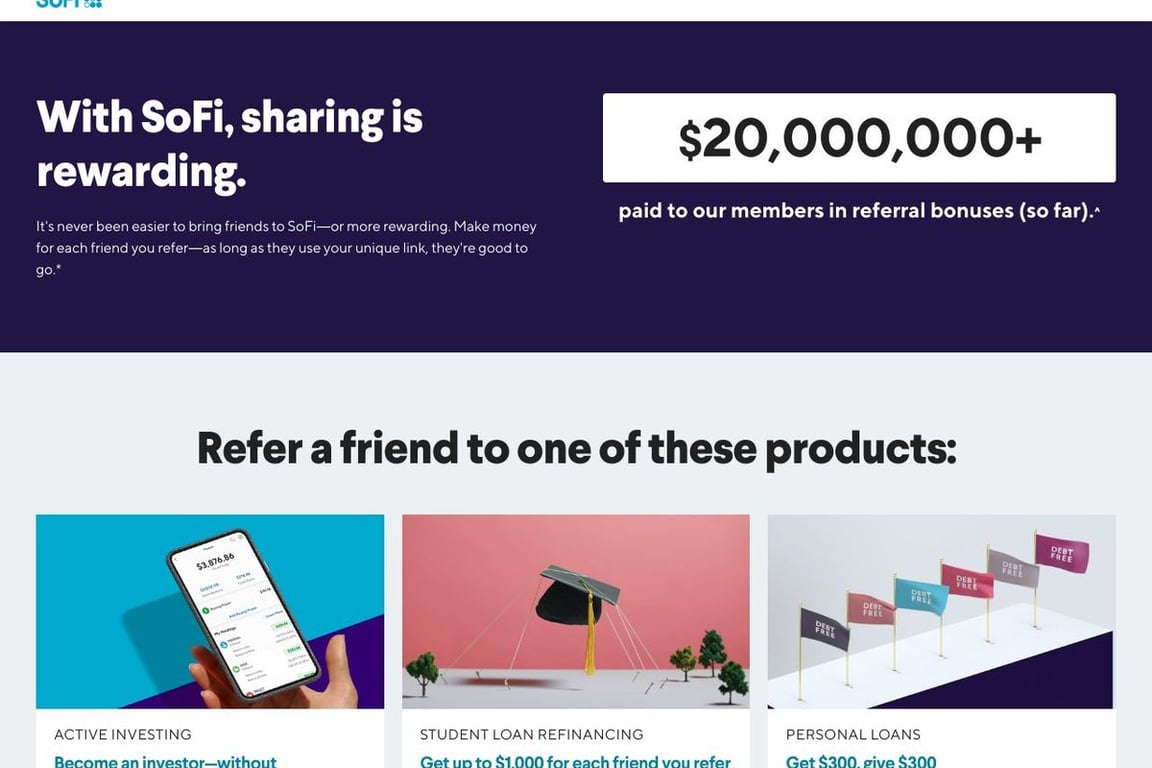

SoFi Loan Affiliate Program US

Affiliates who target financially conscious audiences, such as students seeking refinancing options or professionals looking for personal loans, often find success with the SoFi Loan Affiliate Program. For instance, blogs focused on personal finance or debt management can attract significant traffic and conversions by promoting SoFi’s reputable financial solutions. By emphasizing the company’s $100 customer bonus for using referral links and creating high-value content (e.g., loan guides or success stories), affiliates have increased engagement and conversions.

Pros

- Affiliates can earn $100–$150 per lead for most SoFi products, and $300 for student loan refinancing referrals via the direct referral program.

- Users who apply for loans through referral links can receive a $100 bonus, which encourages engagement.

Cons

- Customers using affiliate links (instead of direct referral links) do not qualify for the $100 bonus, potentially discouraging some conversions.

Smava Loan Affiliate Program Germany

Smava is a Germany-based fintech platform offering consumers a streamlined way to compare and secure personal loans. It provides access to over 70 loan options from more than 20 banks and lending institutions. One notable innovation from Smava is the introduction of loans with negative interest rates for certain customers, effectively allowing borrowers to repay less than they borrowed. Thus, the Smava Affiliate Program is one of the best in the loan affiliate industry.

Pros

- Provides clear comparisons of interest rates, terms, and fees.

- Customers typically save on interest costs compared to traditional loans.

- Negative interest rate loans for eligible borrowers set it apart in the market.

- A fully online application process simplifies access.

Cons

- Contracts are primarily in German, which may pose challenges for non-German speakers.

- Primarily caters to residents in Germany, restricting access for international users.

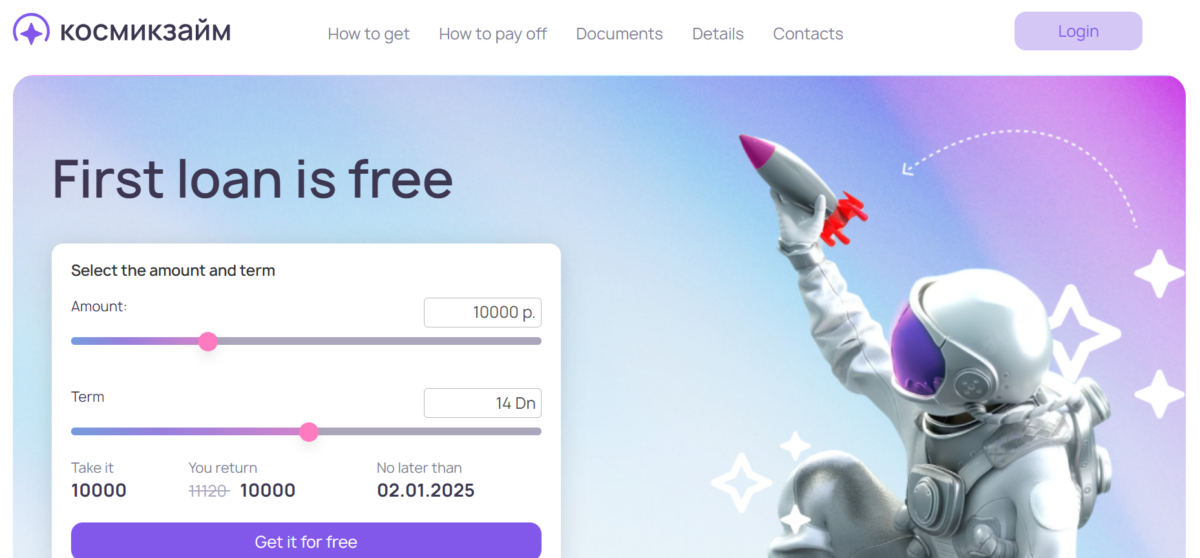

Kosmiczaym Affiliate Program Russia

The Kosmiczaym Affiliate Program focuses on payday and short-term loans, offering opportunities to affiliates to earn through lead generation. It provides tools such as banners, tracking mechanisms, and marketing materials to support affiliate activities. Affiliates can benefit from real-time performance monitoring and competitive commission structures tailored to their traffic quality and volume.

Pros

- Kosmiczaym targets customers seeking urgent financial solutions, increasing lead-to-loan approval rates.

- Covers payday and other short-term loan products, appealing to a broad audience.

Cons

- Payday loan marketing requires strict adherence to financial regulations, which can be challenging for affiliates in different regions.

- Loans need repayment by the next payday, which might not address long-term financial issues effectively.

Empower Cash Advance Affiliate Program US

Empower Cash Advance is a financial app that provides short-term financial solutions, including cash advances, budgeting tools, savings automation, and a debit card. It has gained popularity due to its user-friendly design, transparency, and the absence of mandatory credit checks for cash advances. Thus, the Empower Cash Advance Affiliate Program holds value.

Pros

- No interest or mandatory fees for basic cash advances.

- Transparent pricing with an optional $8 monthly subscription and free trial.

- High-security standards, including 256-bit encryption and multi-factor authentication.

Cons

- Cash advances are capped at $250, which might not suffice for larger emergencies.

- The $8 monthly subscription fee applies even if features are unused.

- Instant delivery fees for cash advances can range from $1 to $8, depending on the amount.

Rupee112 Loan Affiliate Program India

This Rupee112 Loan Affiliate Program is based on CPI and CPA model. You need to make sure users download the Rupee112 app, register, apply for a loan, and get it successfully for your commissions to track.

Again this Indian loan affiliate program has a 30 days cookie and allows cashback/incentive promotions. The commission amount is ₹750. Make a note to target only Rupee112 new users.

eMortgage Home Loan Affiliate Program US

Affiliates typically earn performance-based commissions ranging from $20 to $200 per lead, depending on the service and platform. The eMortgage Home Loan Affiliate Program often includes marketing materials, access to reporting dashboards, and dedicated support for affiliates. Below is an approach you can try for this campaign.

- Target social media focusing on first-time homebuyers.

- Optimize content on mortgage benefits for specific demographics.

- Increase click-through rates by 25% using personalized landing pages.

- Achieve around $50,000 in commissions over six months.

- Importance of tailored marketing materials.

- Necessity of compliance with regional regulations.

Pros

- Competitive payouts for leads, particularly in high-value markets like mortgage refinancing.

- Affiliates can promote a wide range of services, including first-time homebuyer loans, refinancing, and bad credit options.

Cons

- Mortgages have a lengthy sales process, which can delay commission payouts.

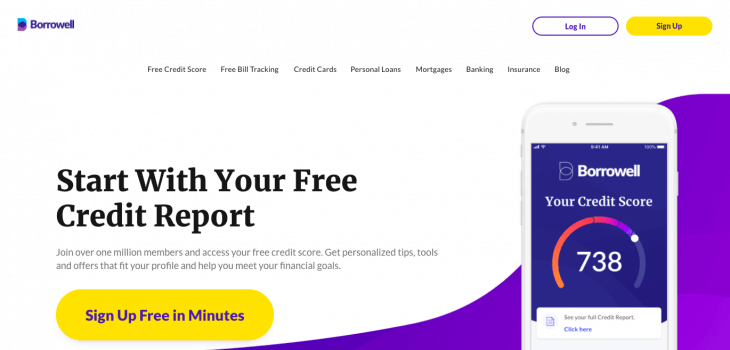

Borrowell Affiliate Program Canada

Borrowell is a Canadian fintech company that offers personal loans, free credit score monitoring, and other financial products. It partners with over 50 lenders to match users with loans tailored to their credit profiles. These are some of the key reasons why affiliates choose the Borrowell Affiliate Program.

Pros

- 5.40% commission on completed signup!

- Borrowers can repay early without penalties

- 1-day cookie period: More than enough for sign-ups

Cons

- APR ranges from 19.99% to 46.96%, which can be costly for borrowers with less-than-excellent credit.

- Borrowell charges a fee of 1-5% of the loan amount.

Finbro Affiliate Program Philippines

Finbro is a lending service in the Philippines that provides personal and business loans. It operates legally and is registered with the Philippine Securities and Exchange Commission. The Finbro Affiliate Program is no exception as it excels in commission rates, conversions, tracking & validation, and almost all key campaign metrics.

Pros

- New borrowers receive their first loan at 0% interest which gives an incredible conversion rate for new users.

- Social Media and Incentive (Cashback/Rewards/Giveaway/etc.) promotions allowed.

- 96.84% validation rate

- Flat ₹687.61 CPL commission.

Cons

- Subsequent loans have interest rates of 0.5%–1.25% per day, which can accumulate significantly.

- Additional charges (Processing Fees, platform fees, etc.) may increase the effective loan cost.

FatakPay Affiliate Program India

This FatakPay Affiliate Program is a CPI and CPA one. Users need to download & install the FatakPay App and complete OTP registration for successful acquisition. The FatakPay App is considered a top choice for instant personal loans due to its customer-focused features and convenience.

Pros

- It is backed by RBI-registered NBFCs, ensuring compliance with financial regulations and secure handling of funds.

- Commission: ₹4.58 per user acquisition.

- Rewards like cashback and savings are provided through merchant partnerships, adding value beyond loans.

Cons

- The effective APR, which can go up to 24.89%, may be higher than some competitors, making it costly for users with longer repayment tenures.

- While customer service is available, reviews suggest occasional delays in resolving issues.

TataNeu Personal Loan Affiliate Program India

The TataNeu Personal Loan Affiliate Program is part of the TataNeu Super App, which offers a variety of services, from shopping and groceries to financial products. This program allows individuals to earn rewards by referring users to apply for personal loans through the platform. Affiliates earn commissions based on loan amounts: ₹375 for loans below ₹99,000, ₹525 for loans between ₹1-₹3 Lakhs, and ₹900 for loans above ₹3,00,001. Additionally, affiliates earn 500 NeuCoins (equivalent to ₹500) for each successful loan conversion, which can be used for purchases within the TataNeu ecosystem. Affiliates can earn up to ₹1,00,000 per calendar month through successful loan disbursals.

Pros

- The rewards in NeuCoins (users also get 500 NeuCoins on successful submission) can be redeemed across TataNeu’s wide range of services, including TataCliq, BigBasket, Croma, and more.

- Backed by Tata, a trusted brand, ensuring reliability and transparency in transactions.

Cons

- Personal loan interest rates, starting at 13.99%, may be higher compared to some competitors for borrowers with lower credit risk.

- The flat Processing fee of ₹1,499 may be disproportionally high for smaller loan amounts.

PersonalLoans Affiliate Program US

PersonalLoans.com is a loan marketplace that connects borrowers with various lenders offering personal loans. The platform caters to individuals with diverse financial needs and credit profiles, allowing borrowers to secure loans ranging from $1,000 to $35,000. Your PersonalLoans Affiliate Program will kickstart from this base.

Pros

- Accepts applications from individuals with a minimum credit score of 580, making it inclusive for borrowers with less-than-perfect credit.

- Dynamic CPC campaign

- Submitting a loan request is free, and there are no mandatory fees charged.

Cons

- As a marketplace, it relies on partner lenders, meaning terms and costs vary widely depending on the lender selected.

- Origination fees and other costs depend on the individual lender, potentially leading to surprises.

OppLoans Affiliate Program US

With the OppLoans Affiliate Program, you can target individuals with poor or limited credit histories. This company offers unsecured loans with amounts ranging from $500 to $4,000, with repayment terms of 9 to 18 months. It is well-suited for borrowers who struggle to qualify for traditional loans but need quick access to funds.

Pros

- OppLoans evaluates borrowers using alternative credit data, making it accessible for those with bad or limited credit.

- Does not charge origination, late, or prepayment fees.

- Reports to major credit bureaus, allowing borrowers to potentially improve their credit scores with timely payments.

Cons

- APR ranges between 160% and 195%, significantly higher.

- Operates in 37 states and Washington, D.C.; borrowers outside these areas cannot apply.

- Repayment terms are capped at 18 months, offering less flexibility than other lenders.

Bad Credit Loans Affiliate Program America

The Bad Credit Loans Affiliate Program connects marketers with a network specializing in loans for individuals with poor credit. Affiliates earn commissions for generating leads and loan applications through their platforms.

Pros

- Loans for individuals with bad credit are in consistent demand, ensuring a steady target audience.

- 60.56% high commission rate on CPS basis

- Affiliates can earn significant commissions per lead or loan conversion due to high competition among lenders.

Cons

- Commission structures and terms can change frequently, impacting affiliate earnings.

Note: The commission rates and campaign type mentioned in this article can change anytime depending on the advertiser and the affiliate marketing network so check for the latest details beforehand.

How to Get Started with a Loan Affiliate Program?

Choose the Right Program, Sign Up, and Review Terms

To succeed with loan affiliate programs, start by selecting a reputable Loan Affiliate Network that has programs that align with your audience and offer competitive commissions. Sign up through their Loan Affiliate Platform and gain access to marketing tools and referral links. Carefully review the program’s terms, including payout structure, lead requirements, and tracking policies, to ensure transparency and set clear expectations for your affiliate partnership.

Promote Products and Track Earnings

Promote loan products through targeted strategies such as blogging, social media, email campaigns, and paid ads (if available), tailoring content to your audience’s financial needs. Use the affiliate program’s tools, like banners and referral links, to enhance visibility and engagement. Track earnings via the program’s dashboard, which monitors clicks, leads, and commissions in real time, helping you measure performance and optimize your promotional efforts for maximum profitability.

Tips for Success in Loan Affiliate Marketing

Focus on Niche Loan Types and Use Content Marketing

Specializing in niche loan types, such as student, small business, or green loans, allows affiliates to target specific audiences and stand out in a competitive market. Combine this with content marketing strategies like creating informative blogs, videos, or guides that address borrower needs and questions. This approach builds trust, drives organic traffic, and increases conversions, ultimately enhancing your success in loan affiliate programs.

Utilize SEO and Promote with Transparent Reviews

To succeed in loan affiliate programs, leverage SEO strategies to optimize content and attract organic traffic from search engines. Focus on high-ranking keywords related to loan products and borrower needs. Additionally, build credibility by promoting loans through transparent reviews that provide honest insights, pros, and cons. This approach fosters trust with your audience, improves engagement, and increases the likelihood of conversions.

How Much Can You Earn with Loan Affiliate Programs?

Understanding Commission Models and Average Earnings

Loan affiliate programs typically offer CPA (Cost Per Acquisition) or CPL (Cost Per Lead) commission models, where affiliates earn based on successful loan applications or qualified leads. Average earnings can vary widely, depending on the loan type, lender, and volume of referrals. However, high-value loans like mortgages often offer larger commissions, making the potential for significant earnings attractive for dedicated affiliates.

Factors That Impact Earnings (Loan Type, Conversion Rates)

Earnings in loan affiliate programs are influenced by factors such as the loan type, with higher-value loans like mortgages typically offering larger commissions. Conversion rates also play a key role—affiliates earn more when their leads are highly qualified and likely to secure loans. Other factors include the commission structure, the lender’s reputation, and the effectiveness of marketing efforts, all of which contribute to overall success and profitability.

Common Mistakes to Avoid

Promoting Irrelevant Products, Not Disclosing Links, and Overloading Content

Promoting irrelevant loan products can damage your credibility and lead to low conversion rates. Not disclosing affiliate links violates trust and transparency, potentially harming your reputation and breaking regulations. Additionally, overloading content with excessive affiliate links can overwhelm readers and reduce engagement. To succeed, focus on relevant products, disclose affiliate relationships, and maintain a balanced, user-friendly content strategy to build trust and maximize conversions.

Failure to Provide Transparent Information

Failing to provide transparent information about loan terms, interest rates, and affiliate relationships can lead to a loss of trust from your audience. It may result in lower conversions and potential legal issues. Affiliates should ensure they disclose all affiliate links, provide clear and accurate loan details, and guide borrowers through the process, fostering credibility and transparency to build lasting, successful partnerships.

Final Thoughts on Loan Affiliate Programs

Why It’s a Profitable Niche and Key Tips for Success

The loan affiliate program is a profitable niche due to the high demand for financial products like personal loans, mortgages, and business loans. Lenders often pay substantial commissions for quality leads or successful loan applications, making it a lucrative opportunity. To succeed, affiliates should focus on targeted content marketing by offering valuable, informative content that addresses borrower needs. SEO optimization, using relevant keywords, helps drive organic traffic. Affiliates should also build trust by providing transparent reviews, disclosing affiliate links, and selecting reputable lenders. With strategic promotion, high-quality leads, and consistent effort, loan affiliate programs can generate significant earnings.

Sahil Ajmera is content writer with more than 7 years of work experience in field of Affiliate Marketing, Digital Marketing etc.

He loves saving money on everything. His aim is to get my readers what they are looking for and that too without wasting much of their time. Whatever he is writing on, you are sure to find a way to earn big and save good!